Market Research

2018 Q4 Industrial Report

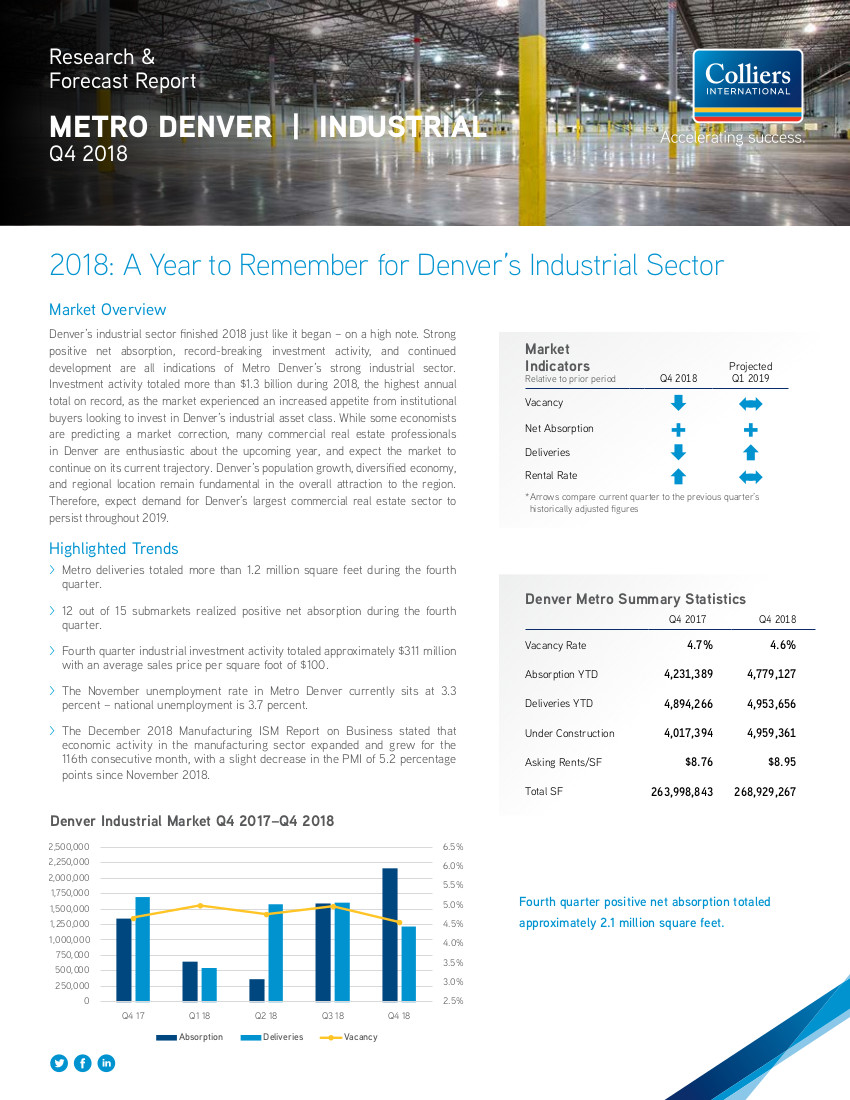

Denver’s industrial sector finished 2018 just like it began – on a high note. Strong positive net absorption, record-breaking investment activity, and continued development are all indications of Metro Denver’s strong industrial sector. Investment activity totaled more than $1.3 billion during 2018, the highest annual total on record, as the market experienced an increased appetite from institutional buyers looking to invest in Denver’s industrial asset class. While some economists are predicting a market correction, many commercial real estate professionals in Denver are enthusiastic about the upcoming year, and expect the market to continue on its current trajectory. Denver’s population growth, diversified economy, and regional location remain fundamental in the overall attraction to the region. Therefore, expect demand for Denver’s largest commercial real estate sector to persist throughout 2019.

2018 North America Big-Box Market Report

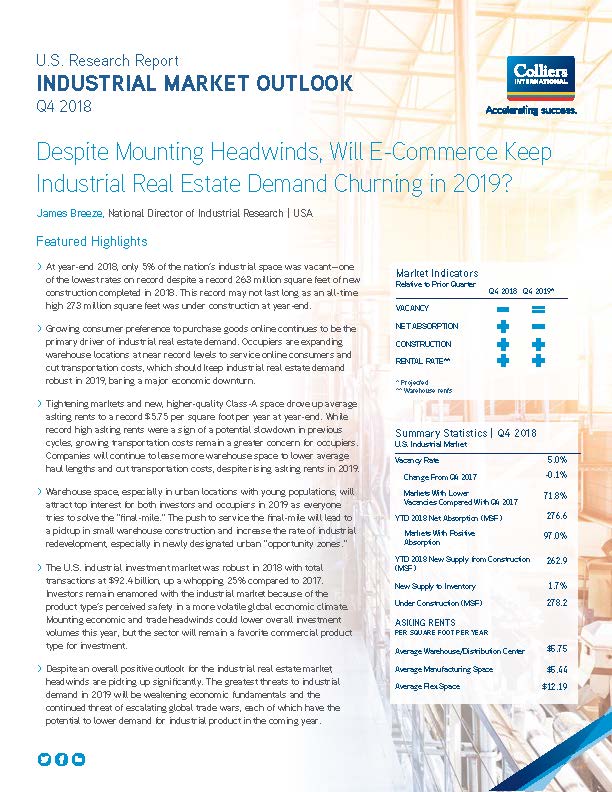

The U.S. industrial market completed its second-best year on record in 2018, with every key indicator at or near all-time highs. E-commerce has the industrial real estate market firing on all cylinders, creating robust demand for big-box buildings, final-mile distribution centers, flex space, and in certain parts of the country, manufacturing facilities.

2018 Year-End Review and Outlook Report

Occupiers’ supply chain strategies throughout the United States are going through immense changes because of the rapid growth of e-commerce. In 2018, much attention was given to the final-mile and the challenges and opportunities that arose from this demand, especially in urban areas. While final-mile real estate got the majority of the press, the backbone of distribution throughout North America remained regional big-box distribution centers. The North American bigbox market continues to ride a wave of robust demand brought on by a solid U.S. economy and, of course, the rapid rise of e-commerce. This demand is fueling record leasing activity, net absorption and development for big-box product throughout North America.

2018 Q4 Office Report

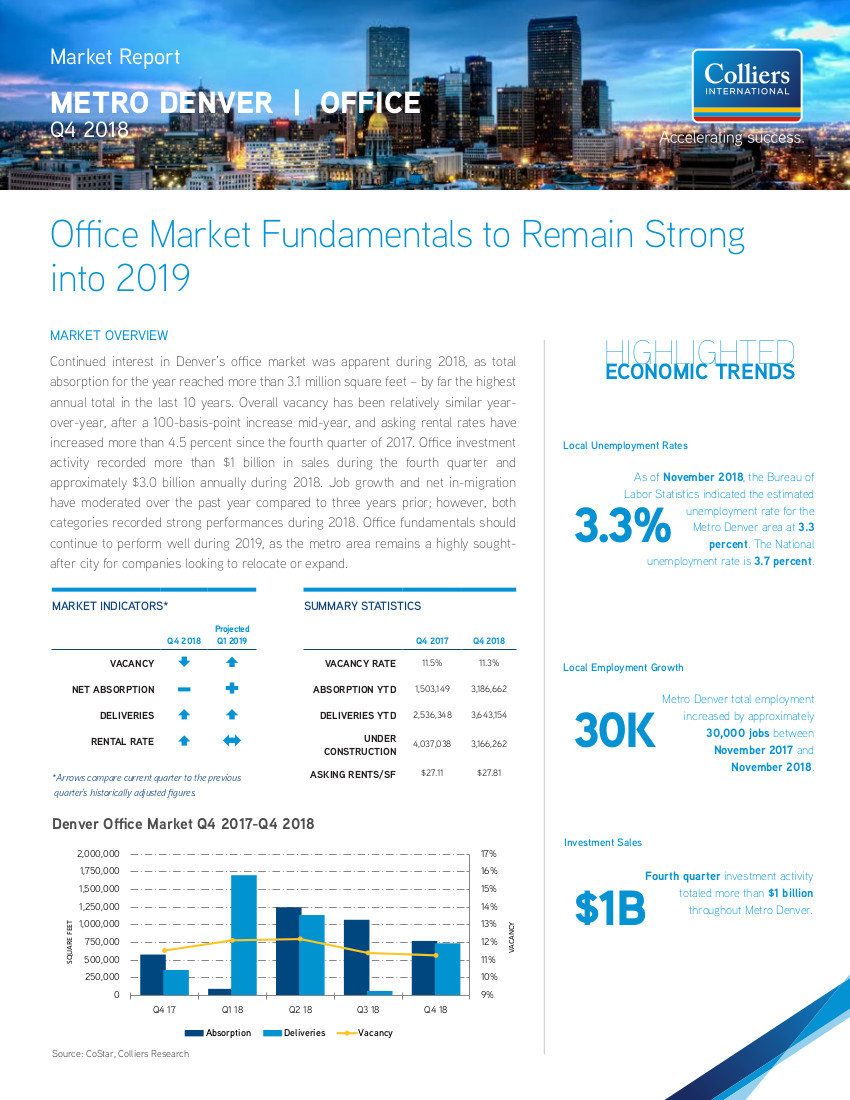

Continued interest in Denver’s office market was apparent during 2018, as total absorption for the year reached more than 3.1 million square feet – by far the highest annual total in the last 10 years. Overall vacancy has been relatively similar year-over-year, after a 100-basis-point increase mid-year, and asking rental rates have increased more than 4.5 percent since the fourth quarter of 2017. Office investment activity recorded more than $1 billion in sales during the fourth quarter and approximately $3.0 billion annually during 2018. Job growth and net in-migration have moderated over the past year compared to three years prior; however, both categories recorded strong performances during 2018. Office fundamentals should continue to perform well during 2019, as the metro area remains a highly sought-after city for companies looking to relocate or expand.

2018 Q4 Retail Report

Denver’s retail sector finished 2018 with strong fundamentals recording approximately 385,000 square feet of positive absorption, increasing asking rental rates and vacancy at 4.7 percent. Significant absorption in the second half of 2018 brings total annual absorption to just over 720,000 square feet. These occupancy gains have compressed the overall vacancy rate to 4.7 percent, decreasing 20 basis points year-over-year. Overall average asking rental rates increased 91 cents year-over-year to a record setting $17.96/SF. Despite over one million square feet of retail product delivered throughout 2018, development activity remains robust with 1.1 million square feet under construction.

Fourth quarter investment activity in the Metro Denver retail sector totaled approximately $196 million, with an average price per square foot of $175/SF, as more than 40 properties transacted. The largest transaction of the quarter was the purchase of a community shopping center in Glendale, which sold for $30 million, or $384/SF. The property was 100 percent leased to PetSmart and Bed, Bath & Beyond.