Market Research

2015 Q4 Industrial Report

The Metro Denver industrial market experienced negative absorption for the first time in ten quarters during the fourth quarter of 2015. Net absorption totaled negative 606,152 square feet due to K-Mart vacating their 1,305,700-square-foot building at 18875 East Bromley Lane in the DIA Industrial Submarket. Negative absorption for the quarter is no cause for concern, as net absorption without the K-Mart vacancy would have reported nearly 700,000 square feet of positive net absorption. Rental rates are continuing to increase across all product types on a quarterly basis despite the increase in vacancy, indicating the optimism of landlords in the marketplace. The metro average rental rate increased to $7.81 per square foot, up $0.30 per square foot from last quarter. Year-over-year, this represents a 17 percent or a $1.13 per square foot increase. Currently, there are 15 projects under construction throughout the metro market, for a total of 2,606,384 square feet. Two buildings were delivered for a total of 127,959 square feet during the fourth quarter.

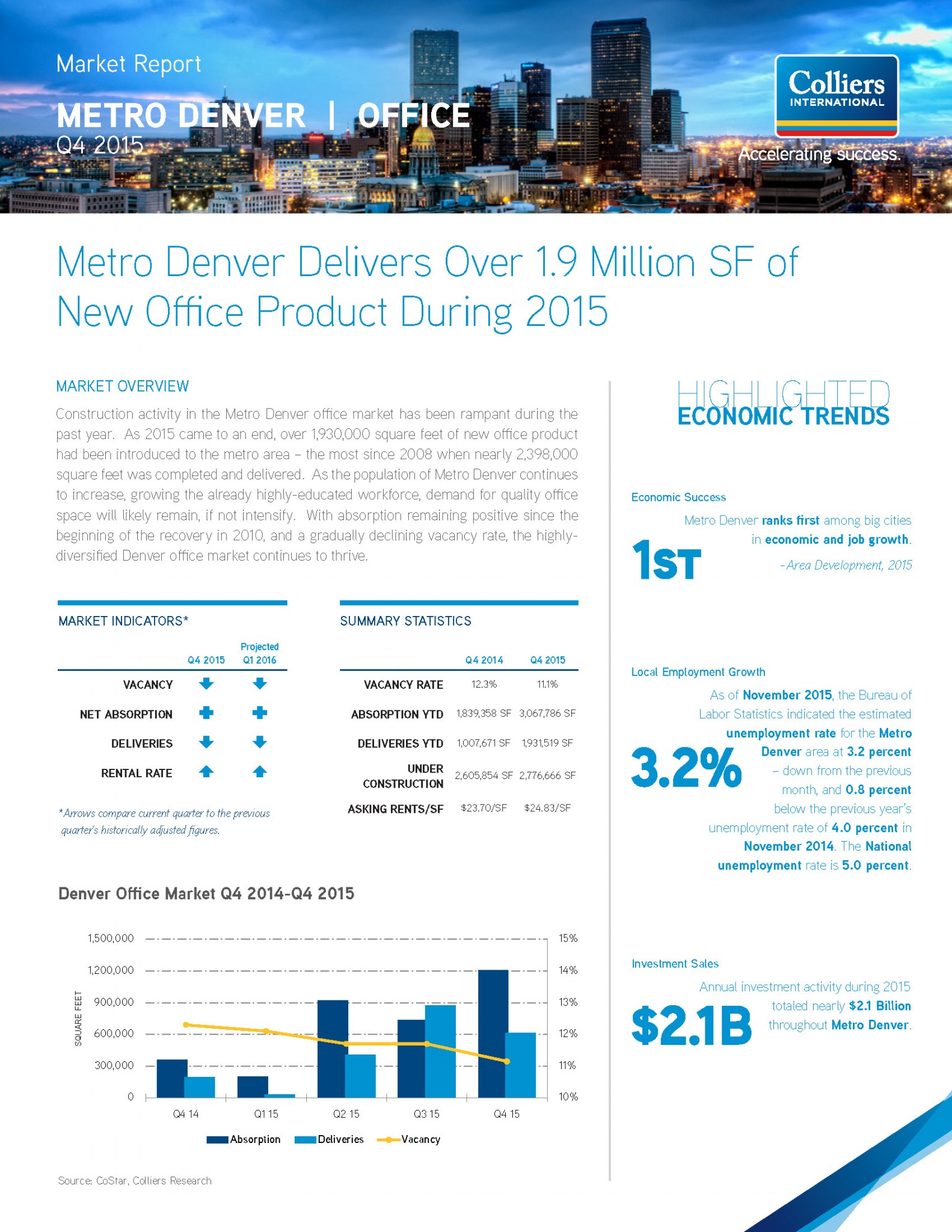

2015 Q4 Office Report

Construction activity in the Metro Denver office market has been rampant during the past year. As 2015 came to an end, over 1,930,000 square feet of new office product had been introduced to the metro area – the most since 2008 when nearly 2,398,000 square feet was completed and delivered. As the population of Metro Denver continues to increase, growing the already highly-educated workforce, demand for quality office space will likely remain, if not intensify. With absorption remaining positive since the beginning of the recovery in 2010, and a gradually declining vacancy rate, the highly-diversified Denver office market continues to thrive.

2015 Q4 Retail Report

The Metro Denver retail market surged during the final quarter of 2015 compared to the second and third quarters. Net absorption doubled that of third quarter absorption totaling over 273,111 square feet of positive net absorption, bringing the year-to-date total to nearly 658,000 square feet. These occupancy gains have compressed the overall vacancy rate to 5.5 percent metro wide, decreasing 20 basis points year-over-year. Overall average asking rental rates increased during the fourth quarter averaging $15.14 per square foot, triple net – up $0.47 per square foot from the previous quarter average of $14.67 per square foot. The year-over-year average rate is up from the fourth quarter 2014 when rates averaged $14.78 per square foot. Current construction projects through the metro consist of 21 buildings totaling nearly 657,000 square feet. Approximately 248,000 square feet of new product was delivered throughout seven buildings during the fourth quarter.