Market Research

2016 Q1 Industrial Report

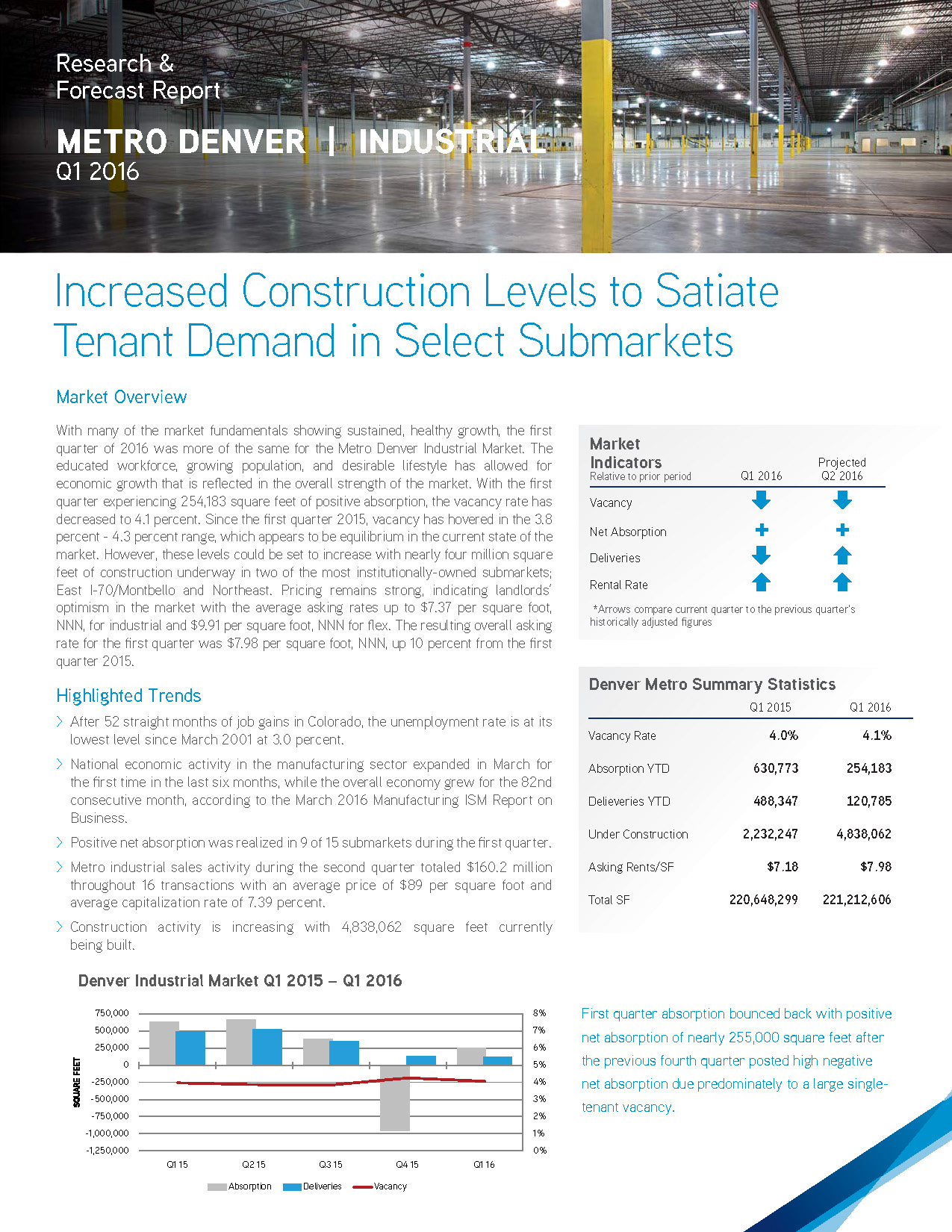

With many of the market fundamentals showing sustained, healthy growth, the first quarter of 2016 was more of the same for the Metro Denver Industrial Market. The educated workforce, growing population, and desirable lifestyle has allowed for economic growth that is reflected in the overall strength of the market. With the first quarter experiencing 254,183 square feet of positive absorption, the vacancy rate has decreased to 4.1 percent. Since the first quarter 2015, vacancy has hovered in the 3.8 percent – 4.3 percent range, which appears to be equilibrium in the current state of the market. However, these levels could be set to increase with nearly four million square feet of construction underway in two of the most institutionally-owned submarkets; East I-70/Montbello and Northeast. Pricing remains strong, indicating landlords’ optimism in the market with the average asking rates up to $7.37 per square foot, NNN, for industrial and $9.91 per square foot, NNN for flex. The resulting overall asking rate for the first quarter was $7.98 per square foot, NNN, up 10 percent from the first quarter 2015.

2016 Q1 Office Report

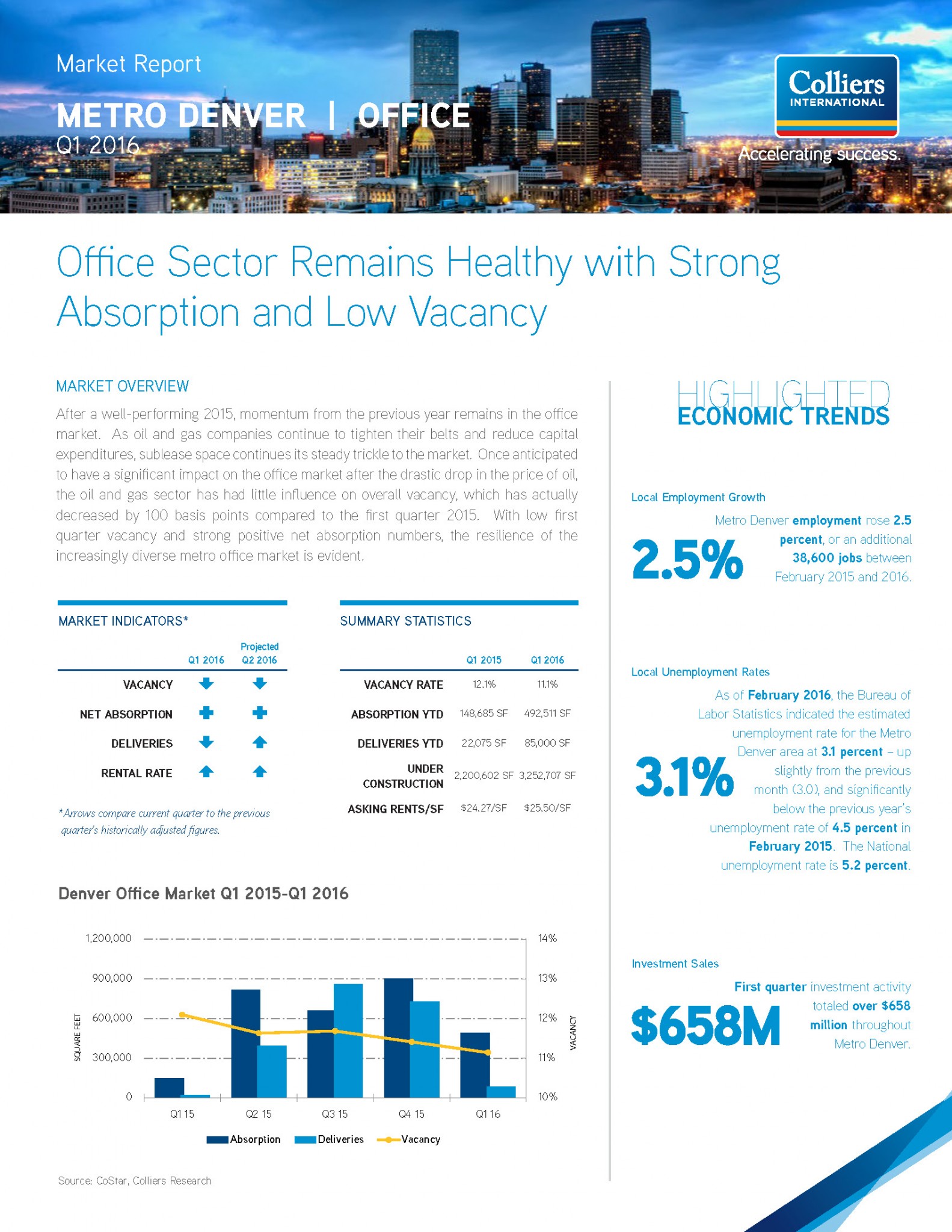

After a well-performing 2015, momentum from the previous year remains in the office market. As oil and gas companies continue to tighten their belts and reduce capital expenditures, sublease space continues its steady trickle to the market. Once anticipated to have a significant impact on the office market after the drastic drop in the price of oil, the oil and gas sector has had little influence on overall vacancy, which has actually decreased by 100 basis points compared to the first quarter 2015. With low first quarter vacancy and strong positive net absorption numbers, the resilience of the increasingly diverse metro office market is evident.

2016 Q1 Retail Report

The retail sector in Metro Denver continued its robust market performance during the first quarter with over 397,000 square feet of net absorption and a vacancy rate of 5.2 percent. After finishing 2015 with a strong fourth quarter performance, retail momentum carried into the first quarter with the Southeast and West markets leading the surge with combined net absorption just shy of 200,000 square feet. Relatively large absorption gains over the past two quarters has positively impacted vacancy rates to historic lows.

The average asking rental rates increased during the first quarter averaging $15.34 per square foot, triple net – up $0.57 per square foot year-over-year from $14.77 per square foot. Current construction projects throughout the metro consist of 18 projects totaling more than 653,000 square feet. Deliveries decreased during the first quarter with 214,000 square feet of new product delivered – down from last quarter’s 10-quarter high of 341,000 square feet.