Market Research

2017 Q2 Industrial Report

Second quarter positive net absorption doubled that of the first quarter total tallying more than 1.1 million square feet. The demand for large blocks of space is evolving as the number of large deals has increased significantly over the last three years. However, a lack of qualified construction laborers and ever-increasing construction costs is impacting the pace of construction. Denver is experiencing significant development and growth during the current cycle, but many smaller tenants are forced to make do with their current space, as rates for new space continues to rise. This allows well-capitalized, larger occupiers the opportunity to consolidate space while others are left to occupy multiple locations. As the metro population continues to surge, the need for large blocks of space will perpetuate as commerce keeps pace with an expanding market. Industrial investment activity remains robust, as many buyers allocate more capital to the sector that has become Denver’s most reliable asset class.

2017 Q2 Office Report

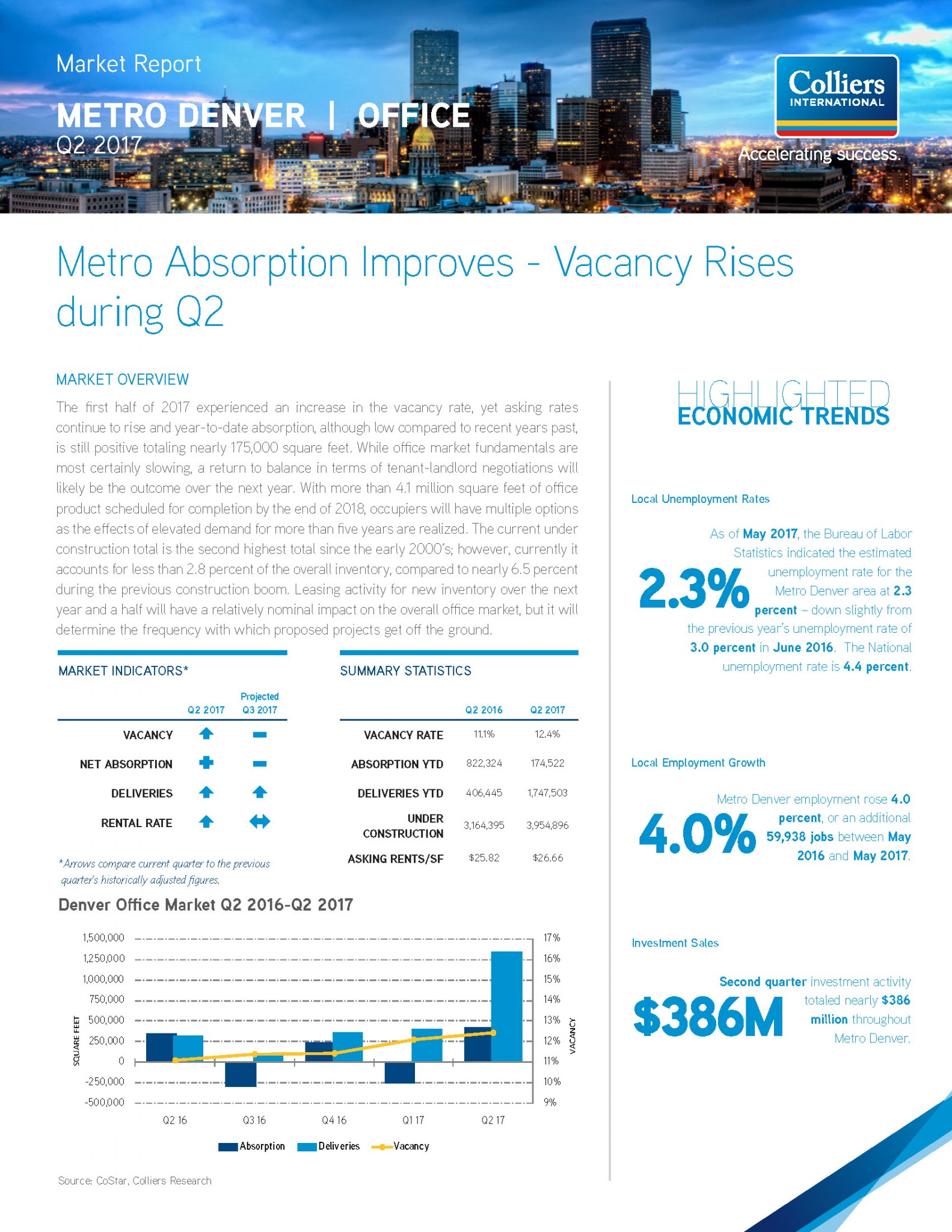

The first half of 2017 experienced an increase in the vacancy rate, yet asking rates continue to rise and year-to-date absorption, although low compared to recent years past, is still positive totaling nearly 175,000 square feet. While office market fundamentals are most certainly slowing, a return to balance in terms of tenant-landlord negotiations will likely be the outcome over the next year. With more than 4.1 million square feet of office product scheduled for completion by the end of 2018, occupiers will have multiple options as the effects of elevated demand for more than five years are realized. The current under construction total is the second highest total since the early 2000’s; however, currently it accounts for less than 2.8 percent of the overall inventory, compared to nearly 6.5 percent during the previous construction boom. Leasing activity for new inventory over the next year and a half will have a relatively nominal impact on the overall office market, but it will determine the frequency with which proposed projects get off the ground.

2017 Q2 Retail Report

Activity in the Metro Denver retail market remained steady during the second quarter across all metrics. Although consumers are willing and able to spend, how they spend continues to evolve. Mixed-use retail complementing office and apartment buildings continue to flourish as the ease of access can meet the convenience of online ordering and provide meeting places and experiences not available online. The retail sector continues to evolve under the pressure of e-commerce, but with in-migration and job growth throughout the metro, retailers have the clientele if they can figure out ways to reach them.

Net absorption for the second quarter came in at 14,107 square feet bringing year-to-date absorption to nearly 300,000 square feet. Relatively low absorption for the second quarter can be attributed to over 117,000 square feet vacated in the Northwest submarket, with the closure of a Safeway and Gordmans. Over 192,000 square feet of retail space was added during the quarter, with the Alamo Drafthouse Cinema and the expansion of Stanley Marketplace making up over half of the deliveries. Average direct retail rents grew by 30 cents to a four-quarter high of $16.68 per square foot. Retail vacancy increased by 10 basis points from the previous quarter to 5.3 percent, which is 10 basis points lower year-over-year.