Market Research

2015 Q2 Industrial Report

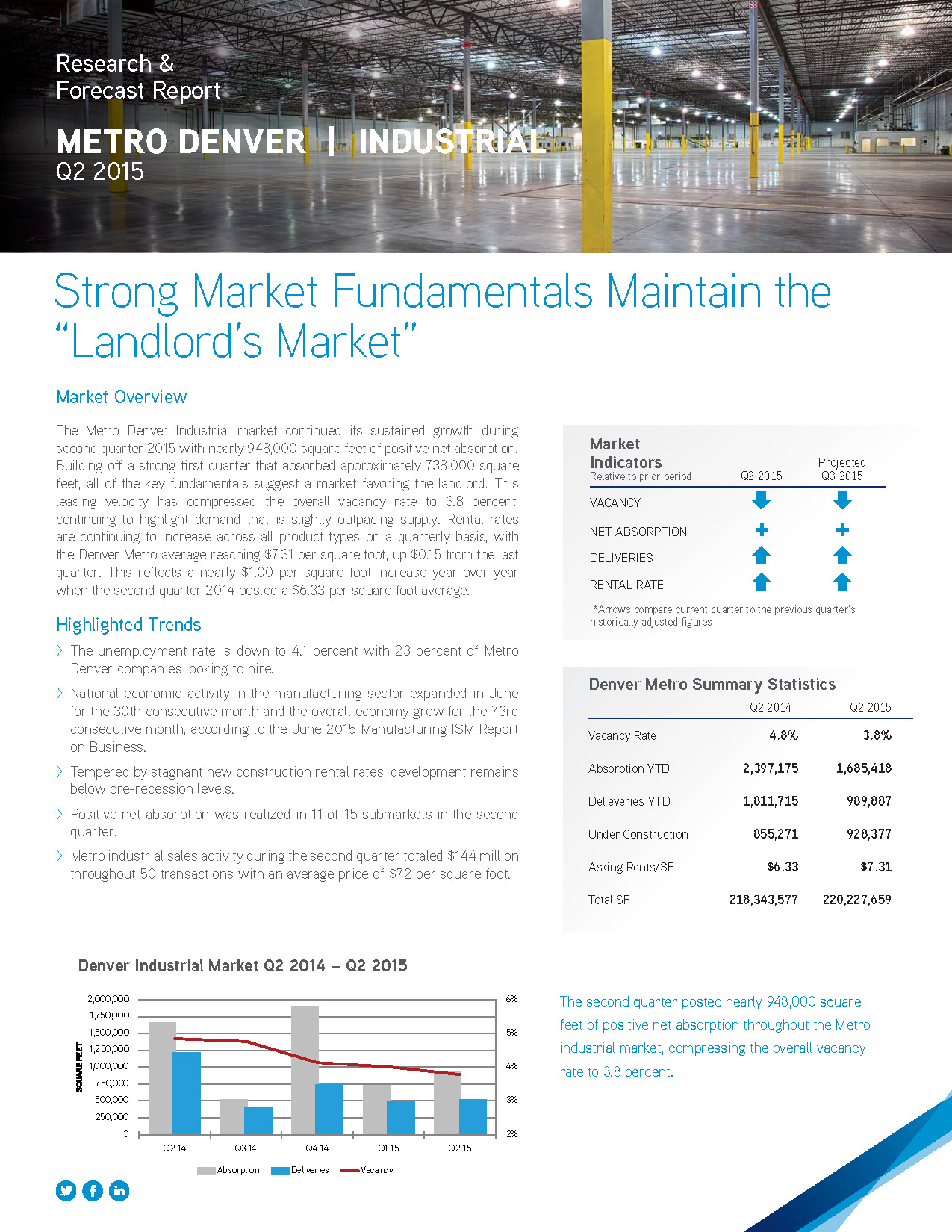

The Metro Denver Industrial market continued its sustained growth during second quarter 2015 with nearly 948,000 square feet of positive net absorption. Building off a strong first quarter that absorbed approximately 738,000 square feet, all of the key fundamentals suggest a market favoring the landlord. This leasing velocity has compressed the overall vacancy rate to 3.8 percent, continuing to highlight demand that is slightly outpacing supply. Rental rates are continuing to increase across all product types on a quarterly basis, with the Denver Metro average reaching $7.31 per square foot, up $0.15 from the last quarter. This reflects a nearly $1.00 per square foot increase year-over-year when the second quarter 2014 posted a $6.33 per square foot average.

2015 Q2 Office Report

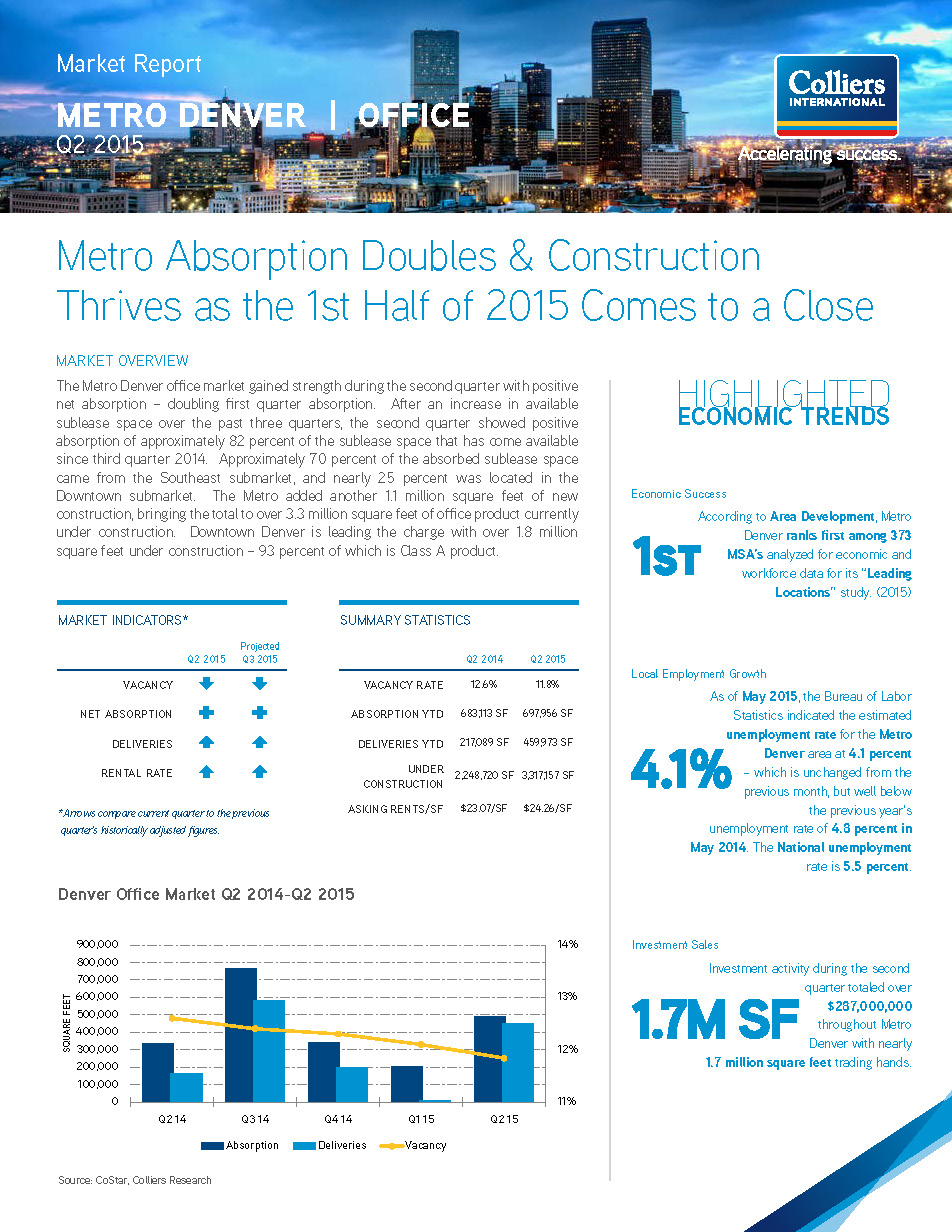

The Metro Denver office market gained strength during the second quarter with positive net absorption – doubling first quarter absorption. After an increase in available sublease space over the past three quarters, the second quarter showed positive absorption of approximately 82 percent of the sublease space that has come available since third quarter 2014. Approximately 70 percent of the absorbed sublease space came from the Southeast submarket, and nearly 25 percent was located in the Downtown submarket. The Metro added another 1.1 million square feet of new construction, bringing the total to over 3.3 million square feet of office product currently under construction. Downtown Denver is leading the charge with over 1.8 million square feet under construction – 93 percent of which is Class A product.

2015 Q2 Retail Report

During the second quarter of 2015, the Metro Denver Retail market reached new milestones on several key measures. Net absorption was positive for the thirteenth straight quarter and the vacancy rate reached the lowest point it has been at in over a decade. Net absorption totaled a positive 262,012 square feet. Overall vacancy rate compressed to 5.8 percent metro wide, which has decreased 0.2 percent from the prior quarter when vacancy sat at 6.0 percent. Average asking rental rates increased during the second quarter, averaging $14.69 per square foot, triple net. This is up $0.14 per square foot from the previous quarter average of $14.55 per square foot, and up year-over-year from the second quarter of 2014 when rates averaged $14.62 per square foot. Currently, there are fifteen retail buildings under construction totaling 323,113 square feet and nearly 89,000 square feet of new product was delivered throughout eight buildings during the second quarter.