Market Research

2020 Q4 Industrial Report

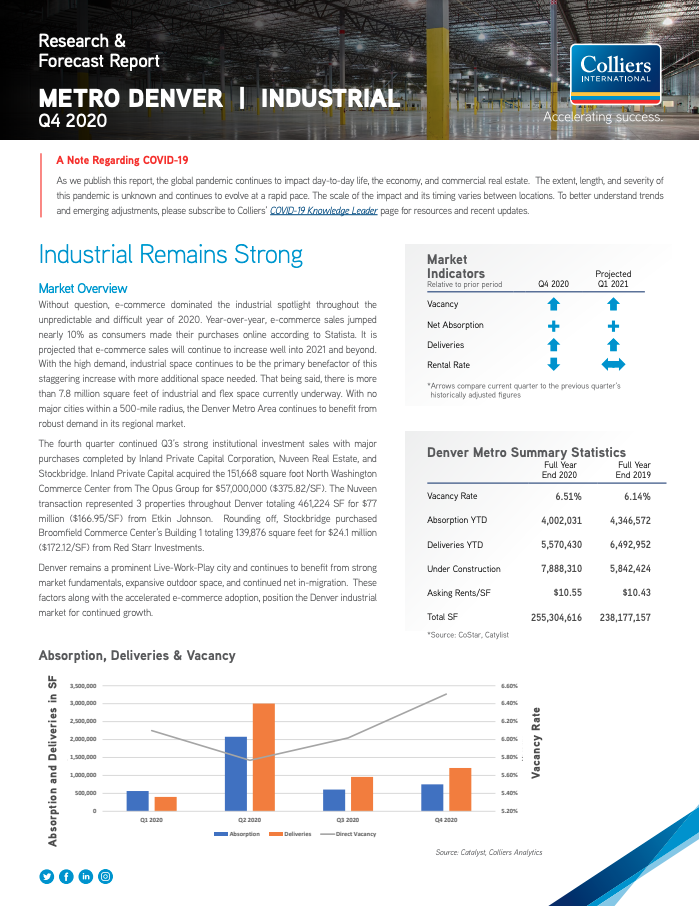

Without question, e-commerce dominated the industrial spotlight throughout the unpredictable and difficult year of 2020. Year-over-year, e-commerce sales jumped nearly 10% as consumers made their purchases online according to Statista. It is projected that e-commerce sales will continue to increase well into 2021 and beyond. With the high demand, industrial space continues to be the primary benefactor of this staggering increase with more additional space needed. That being said, there is more than 7.8 million square feet of industrial and flex space currently underway. With no major cities within a 500-mile radius, the Denver Metro Area continues to benefit from robust demand in its regional market.

2020 Q4 Office Report

Denver Metro’s office market couldn’t escape the effects of the pandemic, creating the first year of softening fundamentals after 10 years of robust growth. The necessity to work-from-home caused significant disruption in office leasing and has many companies reassessing their long-term office space needs. This drove the Metro to realize negative net absorption, increasing vacancy rates, and significant blocks of sublease space in Q4.

2020 Q4 Retail Report

With average daily confirmed COVID cases increasing throughout the holiday season, retail remains in an unprecedented state but hope is on the horizon. The number of unemployed persons fell by over 325,000 in November and vaccine distribution for COVID-19 is well underway. A recent report from Mastercard stated that retail sales rose 3% while e-commerce sales skyrocketed 49% compared to last year. Unfortunately, with COVID still affecting the restaurant scene, it is estimated that more than 110,000 restaurants across the country have closed long-term or permanently according to the National Restaurant Association.