Market Research

U.S. Research Report Q1 2019

While U.S. industrial property fundamentals remain very healthy with record-high asking rents and occupancy, a plunge in overall net absorption was the big story in Q1 2019. Overall net absorption finished at 39.2 million square feet, the lowest quarterly total since Q3 2012. While first quarters tend to be the lowest quarter for net absorption in each year, the decline this quarter of almost 25% was significant for its sheer magnitude. A key factor certainly seems to be a simultaneous drop in new inventory added, so we anticipate a pickup in absorption this spring on the strength of greater deliveries. But we will also be watching for the expected economic slowdown, as well as escalating trade concerns, for any impacts on industrial property demand.

The Single Accounting Change that Will Bring $2 Trillion in Liabilities onto U.S. Balance Sheets

Though its name is puzzling, ASC 842 is surprisingly simple to explain. It is a new accounting standard that requires companies to record most leases longer than 12 months on their financial statements. But that simple alteration means that $2 trillion in liabilities is set to enter the balance sheets of America’s businesses. The resulting financial shock could touch every corner of commercial real estate.

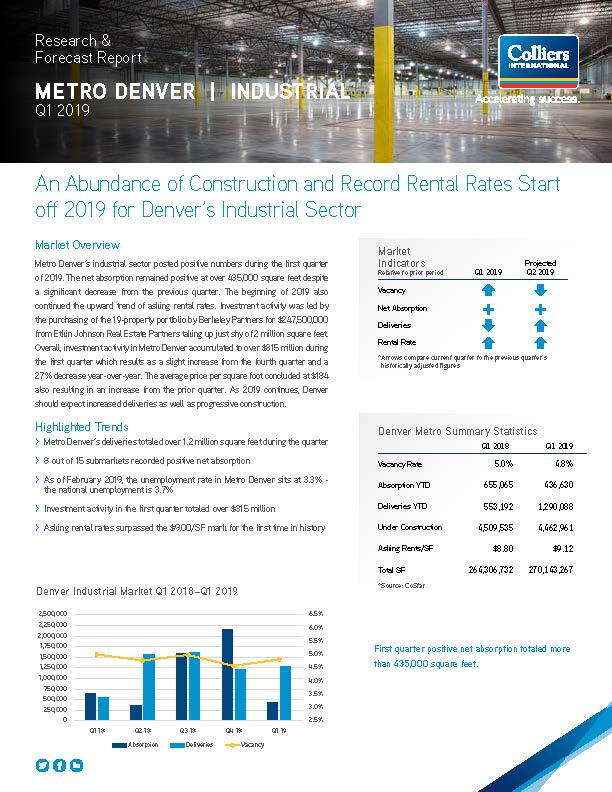

2019 Q1 Industrial Report

Metro Denver’s industrial sector posted positive numbers during the first quarter of 2019. The net absorption remained positive at over 435,000 square feet despite a significant decrease from the previous quarter. The beginning of 2019 also continued the upward trend of asking rental rates. Investment activity was led by the purchasing of the 19-property portfolio by Berkeley Partners for $247,500,000 from Etkin Johnson Real Estate Partners taking up just shy of 2 million square feet. Overall, investment activity in Metro Denver accumulated to over $315 million during the first quarter which results as a slight increase from the fourth quarter and a 27% decrease year-over-year. The average price per square foot concluded at $184 also resulting in an increase from the prior quarter. As 2019 continues, Denver should expect increased deliveries as well as progressive construction.

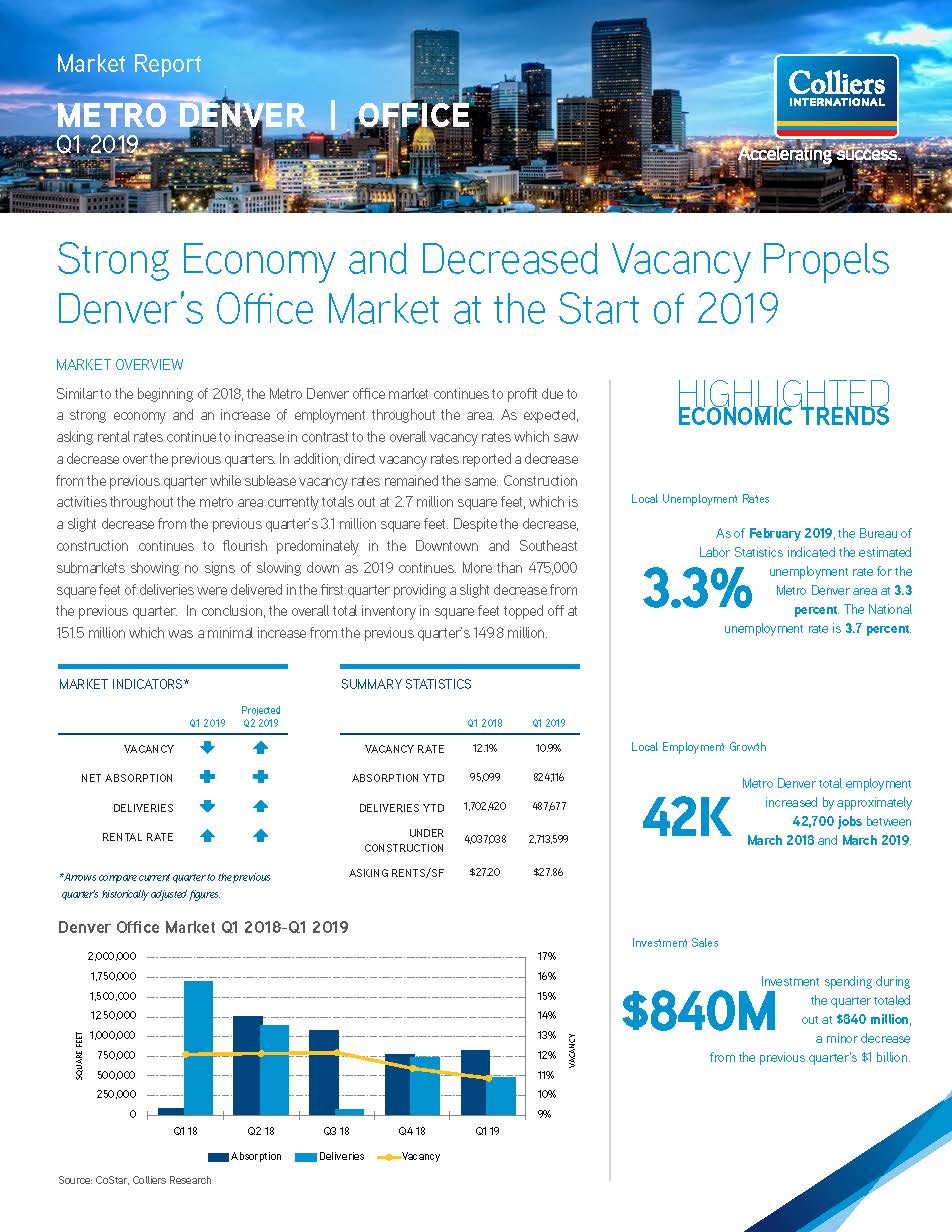

2019 Q1 Office Report

Similar to the beginning of 2018, the Metro Denver office market continues to profit due to a strong economy and an increase of employment throughout the area. As expected, asking rental rates continue to increase in contrast to the overall vacancy rates which saw a decrease over the previous quarters. In addition, direct vacancy rates reported a decrease from the previous quarter while sublease vacancy rates remained the same. Construction activities throughout the metro area currently totals out at 2.7 million square feet, which is a slight decrease from the previous quarter’s 3.1 million square feet. Despite the decrease, construction continues to flourish predominately in the Downtown and Southeast submarkets showing no signs of slowing down as 2019 continues. More than 475,000 square feet of deliveries were delivered in the first quarter providing a slight decrease from the previous quarter. In conclusion, the overall total inventory in square feet topped off at 151.5 million which was a minimal increase from the previous quarter’s 149.8 million.

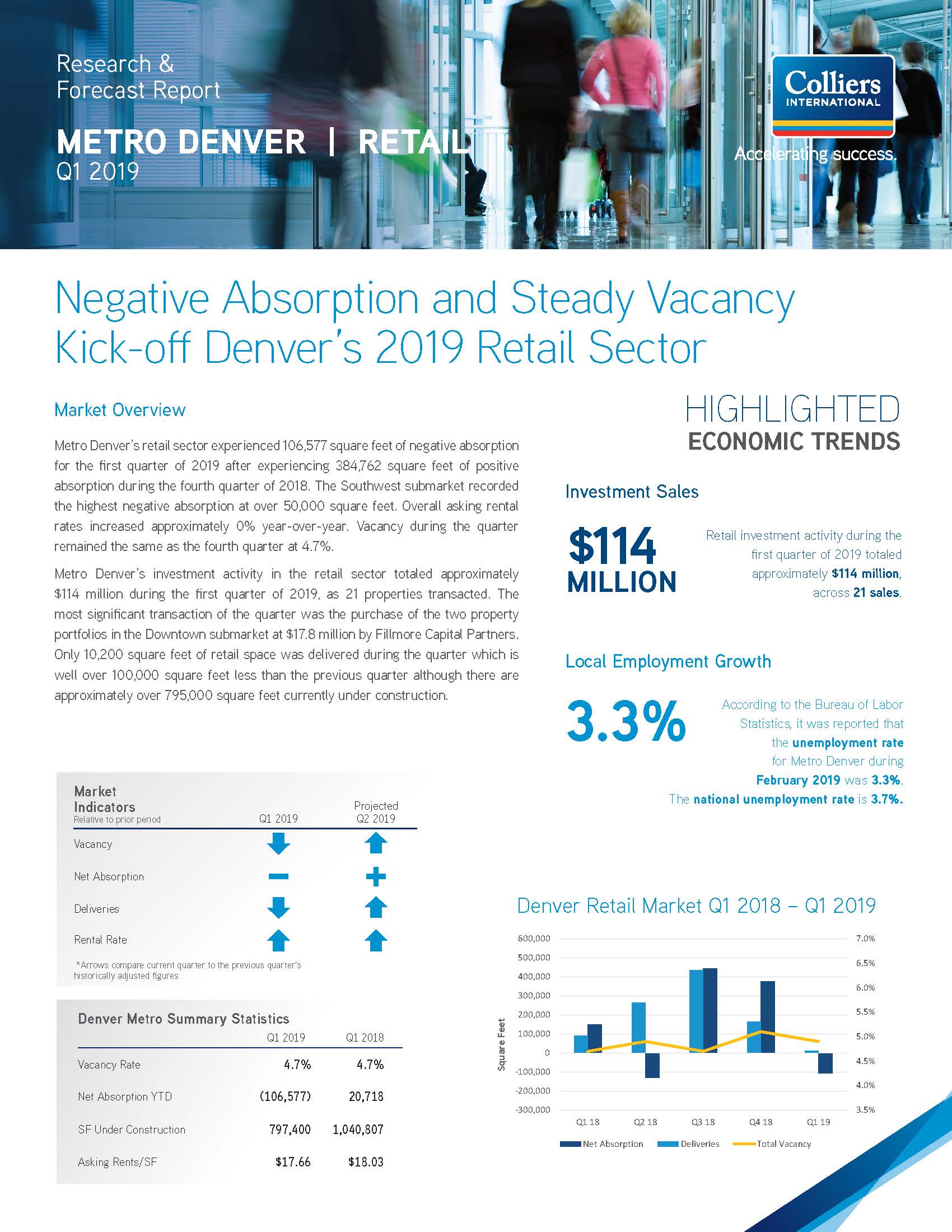

2019 Q1 Retail Report

Metro Denver’s retail sector experienced 106,577 square feet of negative absorption for the first quarter of 2019 after experiencing 384,762 square feet of positive absorption during the fourth quarter of 2018. The Southwest submarket recorded the highest negative absorption at over 50,000 square feet. Overall asking rental rates increased approximately 0% year-over-year. Vacancy during the quarter remained the same as the fourth quarter at 4.7%.

Metro Denver’s investment activity in the retail sector totaled approximately $114 million during the first quarter of 2019, as 21 properties transacted. The most significant transaction of the quarter was the purchase of the two property portfolios in the Downtown submarket at $17.8 million by Fillmore Capital Partners. Only 10,200 square feet of retail space was delivered during the quarter which is well over 100,000 square feet less than the previous quarter although there are approximately over 795,000 square feet currently under construction.