Market Research

2015 Q3 Industrial Report

The Metro Denver industrial market’s steadily increasing absorption slowed slightly during the third quarter of 2015. Net absorption totaled a positive 413,536 square feet, which is less than half of the second quarter 2015 net absorption of 891,174 square feet. As tenants with smaller space requirements scramble for space, the market continues to tighten with vacancy falling to 3.7 percent. This decrease in vacancy represents a 110-basis-point change year-over-year from the third quarter 2014, when vacancy was 4.8 percent. Rental rates are continuing to increase across all product types on a quarterly basis, with the metro average reaching $7.51 per square foot, up $0.20 from last quarter. This represents a $1.09 per square foot increase year-over-year, as a $6.42 per square foot average was posted in the third quarter 2014. Currently, there are seven buildings under construction, totaling 1,467,786 square feet.

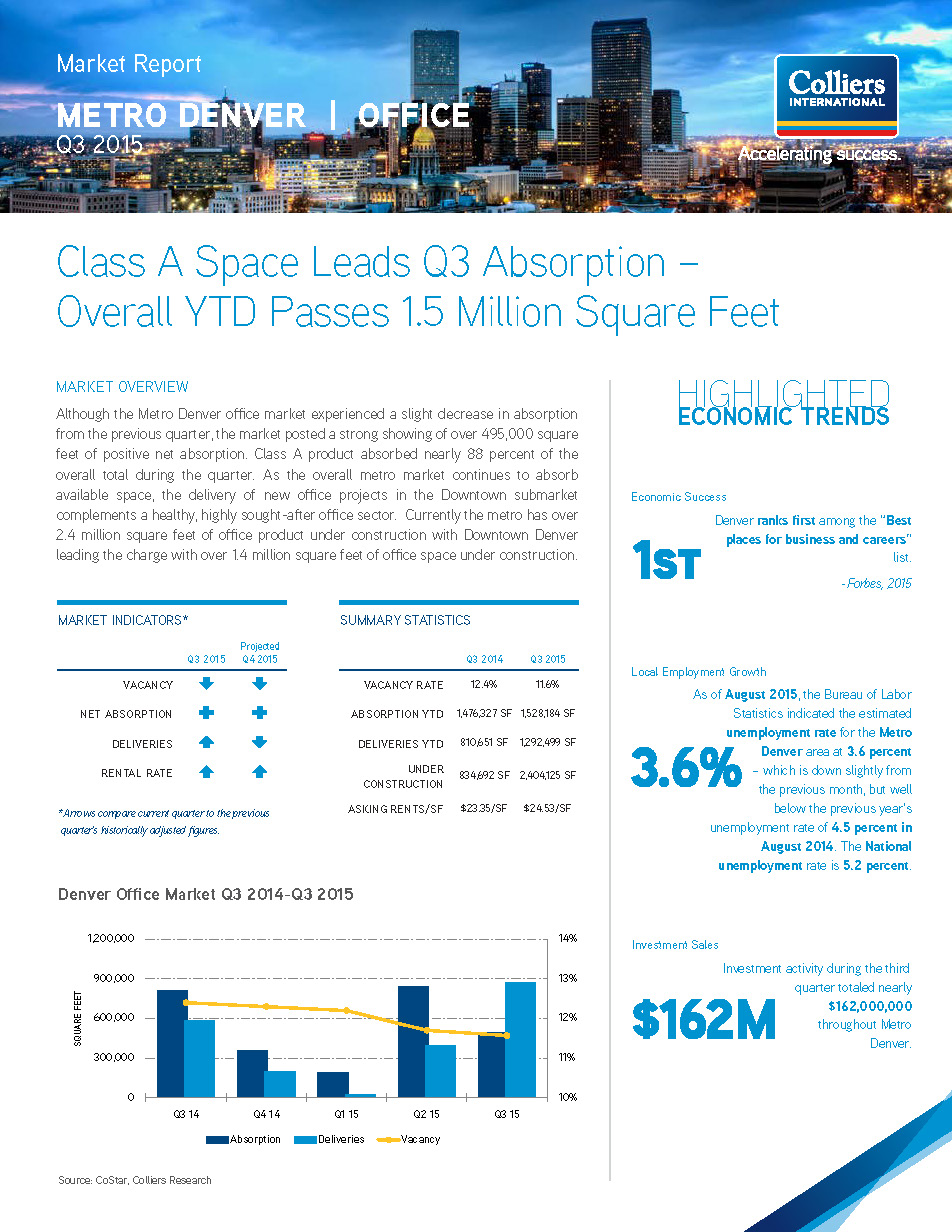

2015 Q3 Office Report

Although the Metro Denver office market experienced a slight decrease in absorption from the previous quarter, the market posted a strong showing of over 495,000 square feet of positive net absorption. Class A product absorbed nearly 88 percent of the overall total during the quarter. As the overall metro market continues to absorb available space, the delivery of new office projects in the Downtown submarket complements a healthy, highly sought-after office sector. Currently the metro has over 2.4 million square feet of office product under construction with Downtown Denver leading the charge with over 1.4 million square feet of office space under construction.

2015 Q3 Retail Report

Backed by strong market metrics, the Metro Denver retail market continued to perform well during the third quarter. For the 14th consecutive quarter, net absorption was positive, totaling 174,593 square feet. The overall vacancy rate decreased 0.1 percent to 5.5 percent metro wide. Year-over-year vacancy has compressed by 50 basis points since the third quarter 2014, when vacancy was 6.0 percent. Average asking rental rates decreased for the fi rst time in 2015 during the third quarter, averaging $14.60 per square foot, triple net. This marks a $0.37 per square foot decline from the previous quarter average of $14.97 per square foot, and a $0.20 per square foot year-over-year decline from the third quarter 2014, when rates averaged $14.80 per square foot. Currently, there is nearly 475,000 square feet under construction throughout thirteen retail buildings. Additionally, over 77,000 square feet of new retail product was delivered during the quarter.