Market Research

2018 Q1 Industrial Report

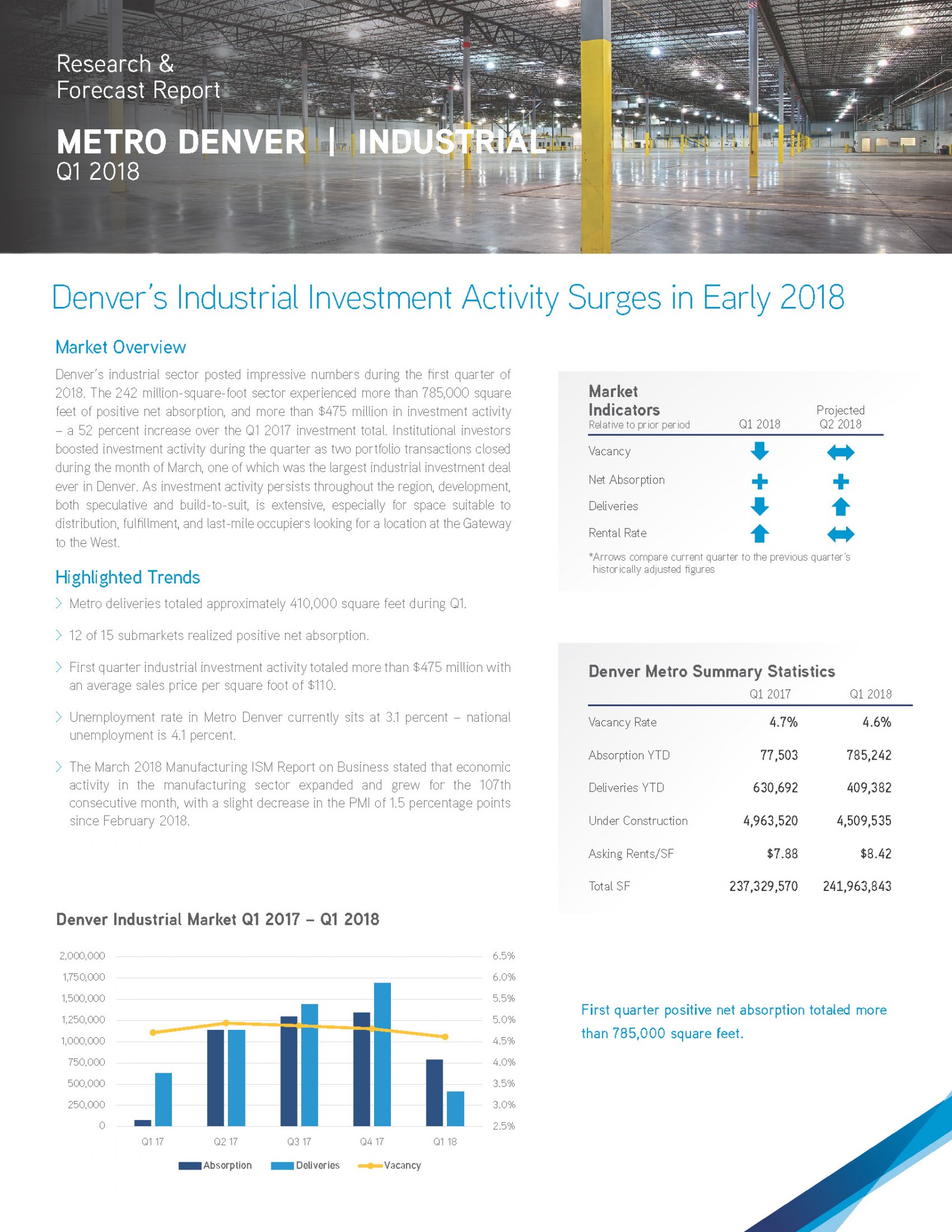

Denver’s industrial sector posted impressive numbers during the first quarter of 2018. The 242 million-square-foot sector experienced more than 785,000 square feet of positive net absorption, and more than $475 million in investment activity – a 52 percent increase over the Q1 2017 investment total. Institutional investors boosted investment activity during the quarter as two portfolio transactions closed during the month of March, one of which was the largest industrial investment deal ever in Denver. As investment activity persists throughout the region, development, both speculative and build-to-suit, is extensive, especially for space suitable to distribution, fulfillment, and last-mile occupiers looking for a location at the Gateway to the West.

2018 Q1 Office Report

Denver’s office market continues to benefit from strong economic fundamentals, as the metro area repeatedly adds to its overall total employment. A continually growing employment base, especially in the professional services sector, is adding to the need for desirable office space not only for occupiers, but also to investors looking to the Denver office market as a reliable venture. Denver’s office market has experienced significant investment activity throughout the past 16 months, with Class A assets in the Downtown and Southeast submarkets driving transaction volume. Current construction activity throughout the metro totals approximately 3.1 million square feet – down slightly from the previous quarter as nearly 1.5 million square feet of new inventory was delivered during the quarter.

2018 Q1 Retail Report

After recording net absorption of more than 546,000 square feet during the previous quarter, Metro Denver’s retail sector experienced approximately 27,000 square feet of negative absorption. The South submarket experienced the most significant of this quarter’s negative absorption, as several big box retailers vacated their space. Overall average asking rental rates increased approximately 7.3 percent year-over-year; however asking rates have remained relatively stagnant increasing only $0.04/sf since mid-2017. Vacancy has remained under 5.8 percent since Q4 2015, and is currently 5.0 percent.

Investment activity in the Metro Denver retail sector totaled approximately $277 million during the first quarter, as 22 properties transacted. The most significant transaction of the quarter was the purchase of the Southland’s Mall in Aurora by M & J Wilkow. The property sold for approximately $142 million, or $184/sf, respectively.