Market Research

U.S. Research Report Industrial Market Outlook Q2 2019

The U.S. industrial market remains on solid ground with record low vacancies and record high asking rents. E-commerce has the industrial real estate market firing on all cylinders, creating robust demand for big-box buildings, final-mile distribution centers, flex space, and in certain parts of the country, manufacturing facilities.

2019 Q2 Industrial Report

Fueled by the rise of e-commerce, Denver’s booming industrial market continued its blistering pace in the second quarter of 2019. Developers delivered nearly 1.5 million SF of new space to the market, on top of the 4+ million SF delivered over the previous four quarters. However, despite all of the new product, the market has only experienced a 30 basis point increase from the 4.5% rate posted a year ago. Not surprisingly, lease rates have climbed quarter after quarter and now average $9.18/SF.

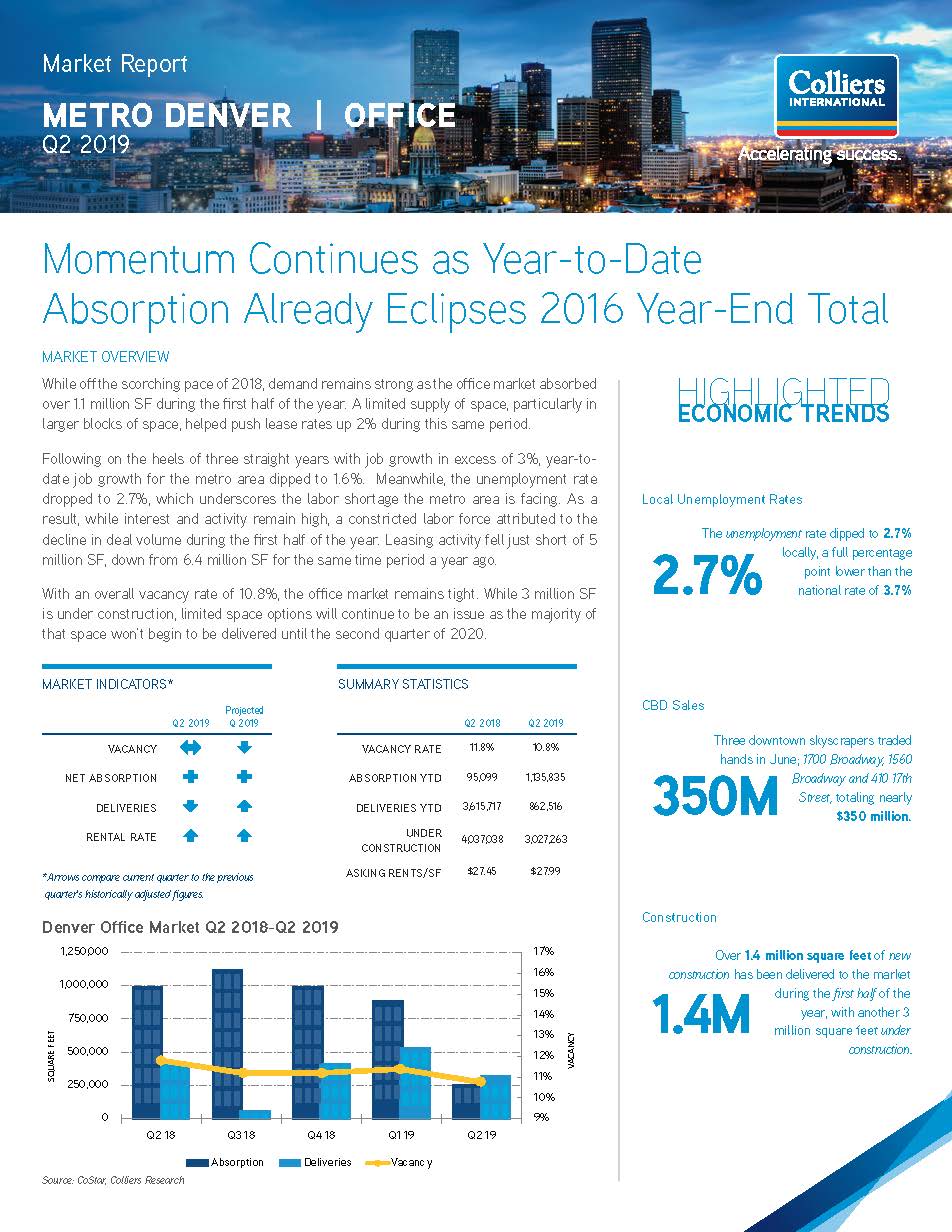

2019 Q2 Office Report

While off the scorching pace of 2018, demand remains strong as the office market absorbed over 1.1 million SF during the first half of the year. A limited supply of space, particularly in larger blocks of space, helped push lease rates up 2% during this same period.

2019 Q2 Retail Report

After stumbling out of the gate in the first quarter by posting just under 400,000 SF of negative absorption, Denver’s retail market made a stronger showing in the second quarter, but ended the quarter slightly in the red at -6,893 SF. Ross Dress For Less opened their 25,000+ SF new store on the northern side of Aurora, which helped the Northeast submarket to post over 45,000 SF for the quarter. Further south, the Aurora submarket recorded -42,649 SF of absorption, of which nearly 19,000 SF was attributed to the Denver School of Massage Therapy vacating.